As the Democrats seem set for a long-drawn out slog to determine their candidate three factors will become increasingly important.

Money talks: after an initial barn-storming start the Clinton campaign has been slower to raise money; whereas Obama has drawn in millions in the last three months. Using CNN’s last quarterly data, it looks as though Clinton should be pretty safe; but in the last six weeks, Obama has raised more healthily than she. Hillary Clinton did better than ‘Big Mo’ predictions (including mine) suggested; and this may help to shake the money tree some more for her. But in a long campaign for the nomination, Obama may be advantaged by the fact that he will be able outspend Clinton in the later stages of this race.

Clinton as at end Q4 2007 (CNN):

Obama as at end Q4 2007 (CNN):

This Democrat desperate spending spree is great news, BTW, for the Republican nominee, come the… you know… actual General Election.

Lack of downtime can lose elections: I have personal experience of this! The Democrats may find they do not have a clear winner by the end of May. This is a disaster for the party! There is every chance that, when we get to the Democrat Convention (Denver, August), it will be a ‘brokered convention’. The eventual nominee will be exhausted – mentally as much as physically. Meanwhile, the Republican candidate – looking more likely to be McCain – will have had a good 2-3 three months to rest (no need to campaign while the Democrats are still slugging it out) mentally and physically, and hone their national campaign message. Hate Bush as many US citizens do; there is now a growing possibility that McCain can beat Clinton, and I think even more likely, Obama, either of whom may both enter the race weakened.

Money talks here too. As the Democrats soak up more and more cash from their wealthy backers for the Primaries, that necessarily presents an opportunity cost for the General.

The White stuff : Early break-out stats suggest Obama is gaining white votes – and how sad that this should be a factor – but he is still to break 40% of white voters in the Democrat primaries to date. Again, this is good for the Republicans. Especially if McCain – once he has the nomination – campaigns on a ’50-state’, more centrist strategy. The Right will hate this, but they will fund it rather than see Obama in the White House.

US voters enjoy balancing the ticket – one party for President and another for Capitol Hill. I think the odds of a McCain one-term Presidency, albeit with a Democrat-led Senate and House, are looking shorter.

PS: Exile says Huckabee for President in 2012; because even if he can do it, McCain can only be a one-term President. And Huckabee’s knee-capping of the Romney campaign yesterday? That must have earned him the VP-slot in a McCann candidacy (nicely delivering the South as it does too – and keeps Anne Coulter-types off of McCain’s back).

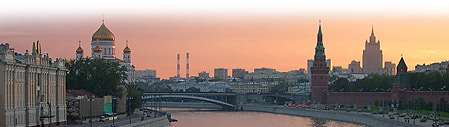

Russia today? Nada caught my eye except: rotten inflation stats for January and a shrinking current account surplus; with RenCap forecasting the current account surplus will fall to zero by end 2009. Like I have said before; supply-side economics are out of kilter with domestic demand and 1-2 years from now, the Russian government is finally going to wake up to this fact, against generally weaker commodity prices: which is 1-2 years too late. As we enter 2010, ‘cheap money’ in Russia is going to be hard to find; the major western economies will still be weak and so where will inward investment in Russia come from then?

Does any of this matter? LOL! Maybe not. But put it this way. If I was the head of a global hedge fund, on a quarter-to-quarter view? I would now be overweight Russian stock to the global equity index I use and would increase my tolerance to Ruble exposure.

Does any of this matter? LOL! Maybe not. But put it this way. If I was the head of a global hedge fund, on a quarter-to-quarter view? I would now be overweight Russian stock to the global equity index I use and would increase my tolerance to Ruble exposure.But, if I was global chief investment officer of a pension fund? I would be looking at a structural position underweight Russian equities, compared to the global index I use, and much less tolerant of RUR exposure, over the medium term. And, yes, I might be buying some more gold.

2 comments:

Shrinking current account surplus and inflation are two problems that cancel each other out, since inflation is caused by the influx of foreign currency into Russia. You sound the alarm bell too early.

I concede that I might be sounding the alarm bell early, but I think you would agree with me that it will, at some point, need to be sounded.

I think I might be more inclined to agree with you if you had used the word 'may'... "two problems that may cancel each other out".

The causes of Russian inflation are I think more complex than foreign currency inflow alone - noting that the Stabilization Fund was in part created to 'steralize' these revenues and neutralize their inflationary effects (and thus try to avoid so-called Dutch Disease).

Wage inflation is an important driver of RUS inflation that may not be entirely current account surplus-dependent; especially tied, as it is, to a decline in the workforce, due to demographic changes (even if only of a generation).

Current government spending may also be inflationary tied as it is to political factors - espcially in terms of salaries and regional grants - other than investment. But I suspect we would both assume that this current 'ramping' spend is a cycle in tune with the political cycle.

Post a Comment